Start of a new month, so updating positions and thoughts –

hence something of an essay.

NAV cob 01Feb13 110.7

GBP

Single

stocks

BP.L Long

10,000

Short

10 Mar 470 calls

RR.L Long

7,000

Short

7 Mar 920 calls

ELTA Long

3,500

PIN Long

6,500

SXX Long

225,000

The

rally has effectively closed out the Rolls Royce long (deep in the money now)

and BP is going the same way – depending on what happens with the negligence

case in the US courts. Electra and PIN are still trading at unjustifiable

discounts to NAV, even though every business they sell is going at a premium to

NAV, so I’m keeping these for now.

Sirius is pure option premium. They need regulatory approval

for a potash mine in Yorkshire – if they get it they’ll have a great position

as a low cost producer of potash, bringing a lot of employment to a deprived

area (amongst other things). High risk, but at least 4:1 on the upside in the long

term.

No changes imminent here – if the rally closes out the BP

and Rolls Royce positions that’s fine, if not then wait till expiry and sell covered

calls again.

GBP

rates

Short

100 L M6, average price 98.735.

Short

20 G H3 (March gilts)

The

short in gilts seems a better way to express this trade than short sterling,

given the supply/demand situation, the likelihood that further UK easing is

more likely to be FLS than QE, and the fact that the gilt market is crowded

with flight-to-safety buyers who are realising that they’ve been running into

the burning cinema rather than out of it.

I think this argues for switching the L M6 position into gilt futures

when the opportunity arises.

JPY

Single

stocks

8316 Sumitomo

Mitsui long

2000

9101 Nippon

Yusen long

40,000

9104 Mitsui

OSK long

30,000

9107 Kawasaki

Kisen long

55,000

Nikkei

NIH3 long

25 (Simex Nikkei)

NIH3

11k calls long

20

NIH3

11.5k calls short

20

The Nikkei still looks like the equity market with the

greatest upside, as it’s chronically under-owned and ridiculously cheap, more

so relative to JGBs than in absolute terms. The NIH3 position should probably

be larger than it is (esp if I get taken out of some of the UK equity positions

listed above). With Nikkei vol so high, selling puts or doing covered calls is

the way to go.

The Sumitomo position is about 1/5 of what it should be, as

the megabanks are such a leveraged trade on reflation. The basket of shipping

lines is more of a special situation, which I’m not going into here as it will

take too long.

JPY

rates

Nothing.

Ideally I’d still have the IRS steepener 5y 3y forward against 5y 20y forward

(positive roll on both legs, and structurally short the back end, which is

where the slow-motion JGB meltdown is already running). Not accessible via futures

only though, so this is off the menu.

As

an aside, a short in long dated JGBs would be close to being my favourite

structural trade right now. The BoJ seems nowhere near to buying the long end,

and the bear market has already started. Higher USDJPY, inflation

pressure and the risk of reflation running out of control, and the calamitous

state of public finances are some of the key factors in favour of this trade.

JPY

currency

GBPJPY long

0.75m

GBP

is still suffering from the overhang of safe haven flows, or so it seems. The

trade is to switch into an equal basket of USD and NOK (can’t bring myself to

buy EUR). Besides, NOK is probably the first central bank in the

world to actually start raising rates, so NOKJPY is a great cross to own from

that perspective (and others). The short side in JPY speaks for itself.

There’ll be no let-up in the pressure while Shirakawa is still

running the BoJ, as people will hang their hopes (maybe correctly) for further

jpy weakness on getting an ultra-dovish successor.

USD

Equities

ESH3 long

100

ESH3

Feb 1470c short

50

ESH3

Feb 1475c short

50

This is just a synthetic short in the Feb 1470 puts and 1475

puts with 2 weeks left to run (I took off the 1475 puts on Wed as I had too

much tail risk ahead of payrolls, but reset it again this afternoon right after

the number for a net cost of 2 points : cheap). These puts have halved after

payrolls, now that the event risk of payrolls is gone and since the market has

rallied too.

ESM3

Mar28 1440 call Long

100

ESM3

Mar28 1470 call Short

100

Bought this call spread today for 6.5 points (30 points

wide, so about 5:1). This is really

cheap upside exposure : the market still seems underweight in stocks (there was

almost no noticeable month end re-weighting trade : you’d have expected an

equity selloff and fixed income rally after the moves in Jan. Instead we got

nothing, suggesting people are using the mkt move to get closer to benchmark). That

said, 1570 is clearly a barrier for the rally, so selling the upside beyond

there looks obvious. Hence the

call spread.

Tactically I think the trade is to get another few days of

time decay on the short position in Feb 1470 and 1475 puts before covering

them, and then to sell the Mar28 1460 puts, which are around 15 points. I get

paid 15 points for the 1460 puts, against paying 6.5 points for the 1540/1570 call spreads – ie both 40 points

out of the money. So I can buy 100 call spreads against just 50 puts for zero

cost. And the expiry ties in nicely to quarter end and Japanese year end –

perfect for a window dressing rally… On top of that 1460 looks like a level

where you ought to buy the market outright anyway, so being exercised on those

puts is something I’d be comfortable with (given a Fed on perma-hold after

today’s uptick in unemployment). In fact I can’t think of a better backdrop for

stocks :

-

stable, if low, nominal GDP growth, so steady

revenue growth

-

no cost pressure from wages or energy

-

a market that still seems underweight (no

pullbacks to cover the underweight inherited from the fiscal cliff

negotiations)

-

Fed on perma-boost at $85bn a month of QE

-

AAPL already deflated, so that risk is

neutralised

-

Fiscal cliff deferred, if not properly solved

USD rates

EDZ4 -

long 75

EDZ7 -

short 125

3em6

98.125p -

long 350

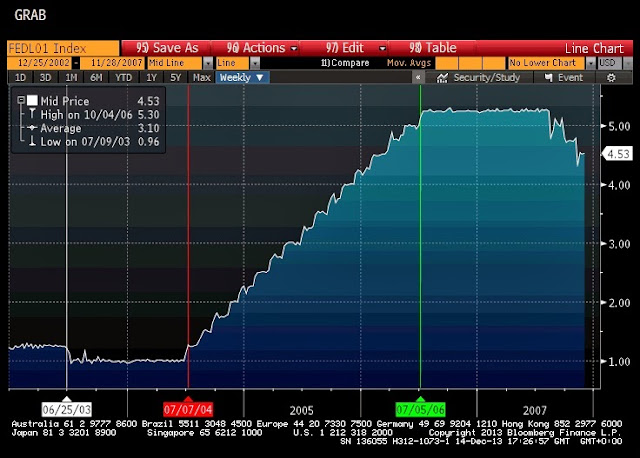

The EDZ4/EDZ7 steepener is insurance for the Fed changing

their mind. If they’re wrong, and the labour market recovers sooner than they

expect, then EDZ7 is mispriced by at least 100bps. And that’s before anyone’s

unwound a single carry trade. At the same time, EDZ4 is near the top of its

range, so I’ve sold out 40% of the long position and working orders to sell the

remaining 60% in equal clips at 99.41/99.47/99.49. Look to buy back the 40% I’m

underweight in EDZ4 at 99.28/99.21.

The blue Jun 81 puts are interesting. I have 350 of these at

an average of 6.5bps. They ought to expire worthless, but the risk/return there

is amazing. Time decay won’t be an issue for a month or two yet so nourgent

issues there. The chart looks like it’s breaking down to 98.35 – but this

contract traded 97.40 in Mar12. There’s a thought.